Scoping visit by the U.S. Department of the Treasury to assess the Technical Assistance requirement of Sri Lanka to enhance the Anti Money Laundering and Countering of Terrorist Financing capacities - December 15 - 19, 2025

The U.S. Department of the Treasury, in collaboration with the U.S. Embassy in Sri Lanka, undertook a Scoping Mission from 15 to 19 December 2025 to assess Sri Lanka’s technical assistance (TA) requirements for strengthening Anti-Money Laundering and Countering the Financing of Terrorism (AML/CFT) capacities. The objective of the mission was to identify priority areas for a tailored technical assistance program aimed at enhancing law enforcement and prosecutorial effectiveness, strengthening financial investigation capabilities, and improving inter-agency coordination among Law Enforcement Agencies (LEAs).

The delegation included officials from the U.S. Department of the Treasury, led by Ms. Rachel Irmen, Associate Director, Economic Crimes Team, Mr. Kevin Whelan, former Resident Advisor to Sri Lanka, Mr. Cory Downs, Law Enforcement Expert specializing in ML/TF investigations, case development, and operational coordination, and Mr. Bradley Gardner, Representative, U.S. Embassy, Sri Lanka.

During the visit, the delegation met with the Governor of the Central Bank of Sri Lanka, in his capacity as Chairman of the National Coordinating Committee (NCC) on AML/CFT. The delegation also held discussions with senior representatives from key stakeholder institutions, including the Attorney General’s Department, Sri Lanka Police, the Commission to Investigate Allegations of Bribery or Corruption (CIABOC), Inland Revenue Department, Sri Lanka Customs, and other relevant agencies. In addition, meetings were conducted with financial sector regulators, namely the Insurance Regulatory Commission of Sri Lanka, Securities and Exchange Commission, Bank Supervision Department, Department

of Supervision of Non-Bank Financial Institutions, Payment and Settlement Department, Department of Foreign Exchange, and the Financial Intelligence Unit.

The Scoping Mission was successfully concluded, with the with a shared understanding that the proposed technical assistance program is expected to continue for a period of two to three years commencing in 2026.

Technical Assistance by the UK HM Treasury, Coordinated by the Asia/Pacific Group on Money Laundering, for Sri Lanka’s 3rd Mutual Evaluation

With the coordination of the Asia/Pacific Group on Money Laundering (APG), the United Kingdom’s (UK) HM Treasury, in collaboration with the British High Commission in Sri Lanka, provided Technical Assistance (TA) to Sri Lanka in preparation for the upcoming Mutual Evaluation (ME) on Anti-Money Laundering and Countering the Financing of Terrorism (AML/CFT) targeting Sri Lanka’s 3rd ME scheduled to commence in 2026.

As part of this initiative, a delegation from HM Treasury visited Sri Lanka from December 8 to 11, 2025, to deliver TA on Immediate Outcome 3 and IO 4, relating to supervision and preventive measures, for Financial Institutions and DNFBPs respectively. The programme was conducted under the leadership of Ms. Claire Emma Wilson, Illicit Financial Technical Assistance Advisor, Technical Assistance Unit, and Mr. George Edward Macauley Sherwin from the UK HM Treasury.

The four-day programme focused on pre-ME preparation, writing of case studies and mock interviews for regulators. This engagement was highly valuable and significantly strengthened the regulators’ preparedness for the upcoming ME.

During the visit, the delegation also met with the Governor of the Central Bank of Sri Lanka to discuss the regulators’ progress, key challenges, and strategic priorities ahead. Ms. Theresa O’Mahony, Acting High Commissioner, and Ms. Lakshila Wanigasinghe, Economics and Prosperity Officer of the British High Commission, also participated in the meeting and expressed their willingness to support Sri Lanka’s AML/CFT Regime.

Capacity Building Workshop on Designing the National Financial Inclusion Strategy (NFIS) Phase II – November 19 and 20, 2025

The Regional Development Department of the Central Bank of Sri Lanka (CBSL), with the participation of the Financial Intelligence Unit (FIU) and several other key departments, successfully organized a Capacity Building Workshop on Designing the National Financial Inclusion Strategy (NFIS) Phase II. The two-day programme was designed to support CBSL in conducting a comprehensive review of NFIS Phase I (2021–2024) and to enhance institutional capacity for independently designing and implementing NFIS Phase II with a strong focus on emerging priorities.

The workshop brought together a panel of international experts, including Ms. Bhavana Srivastava (Team Leader & Financial Inclusion Strategy Expert, Fin Value), Ms. Aashraya Sharma (Monitoring and Evaluation Expert), Ms. Sandhya Saraswathi (Research Associate), and Ms. Laura Ramos (Senior Policy Manager, Inclusive Green Finance, Alliance for Financial Inclusion – AFI). Their technical input covered several critical thematic areas:

• Inclusive Green Finance

• Consumer Protection

• Market Conduct Supervision

Held at The Kingsbury Hotel, Colombo, the sessions saw active participation from multiple CBSL departments including the Bank Supervision Department, Department of Supervision of Non-Bank Financial Institutions, Payments and Settlements Department, Financial Consumer Relations Department, and Macroprudential Surveillance Department, along with two representatives from the Financial Intelligence Unit. The programme also incorporated practical exercises and interactive discussions, enabling participants to apply concepts to real-world scenarios and strengthen cross-departmental collaboration.

This workshop marks an important step toward shaping a more resilient, inclusive, and forward-looking financial landscape in Sri Lanka, laying a strong foundation for the successful development and implementation of NFIS Phase II.

India Extends Technical Assistance to Strengthen Sri Lanka’s AML/CFT Framework Ahead of Mutual Evaluation

The Department of Revenue of India, in collaboration with the High Commission of India in Sri Lanka, continued its technical assistance programme aimed at supporting national preparations for the upcoming Mutual Evaluation (ME) on Anti-Money Laundering and Countering the Financing of Terrorism (AML/CFT). As a part of this initiative, two high-level Indian delegations visited Sri Lanka during September and November 2025, respectively.

The first visit took place in September 2025 and was steered by the experts from the Central Board of Direct Taxes, Central Bureau of Investigation, Financial Intelligence Unit, and the Financial Action Task Force Cell of the Ministry of Finance, Government of India. The high-level meeting with the Indian delegation was chaired by Dr. P Nandalal Weerasinghe, the Governor of the Central Bank of Sri Lanka (CBSL), with the participation of Hon. Justice (Rtd.) Buwaneka Aluwihare, P.C., Chairman, AML/CFT Task Force, Prof. Anil Jayantha Fernando, Hon. Minister of Labour and then Deputy Minister of Economic Development, Dr. Harshana Suriyapperuma, Secretary to the Treasury, Ministry of Finance, Mr. Harshana Nanayakkara, Hon. Minister of Justice and Mr. Parinda Ranasinghe P.C., Hon. Attorney General.

The second delegation included senior officials from key Indian regulatory and supervisory authorities, including the Reserve Bank of India, the Financial Intelligence Unit, the Insurance Regulatory and Development Authority and the Securities and Exchange Board of India. A key highlight of the programme was the high-level discussion on Digital Payments and the Regulation of Virtual Asset Service Providers, which was chaired by the Governor of the CBSL. The discussion was attended by the Hon. Deputy Minister of Digital Economy, Eng. Eranga Weeraratne. Secretary to the Treasury, senior officials from the Ministry of Digital Economy, the Ministry of Finance, and the Inland Revenue Department.

Annual High-Level Awareness Conference for Licensed Banks, Licensed Finance Companies, Money or Value Transfer Service Providers, Primary Dealers, Stockbrokers and Micro Finance Companies in Sri Lanka - November 27, 2025

The Financial Intelligence Unit (FIU) of Sri Lanka successfully conducted its Annual High Level Anti Money Laundering, Countering the Financing of Terrorism and Proliferation Financing (AML/CFT/CPF) Awareness Conference on November 27, 2025 at the Central Bank of Sri Lanka, bringing together nearly 240 participants, including Chairpersons, Board Directors, and Senior Management from Licensed Commercial Banks, Licensed Specialized Banks, Finance Companies, Money or Value Transfer Service Providers, Primary Dealers Institutions, Stockbroker Firms, and Microfinance Institutions.

Dr. Subhani Keerthiratne, Director of the FIU made a presentation on “Improving Governance Framework: Ensuring Greater Accountability of the Board of Directors for the Compliance Obligations of Anti Money Laundering, Countering the Financing of Terrorism and Proliferation Financing”. The conference concluded with vote of thanks delivered by Mrs. Theja Pathberiya, Deputy Director of the FIU, acknowledging the participation and the contribution of all participants.

Awareness Session on Managing Financial Crime Risks in the Financial Services Sector of Sri Lanka (Programme 18) - November 06, 2025

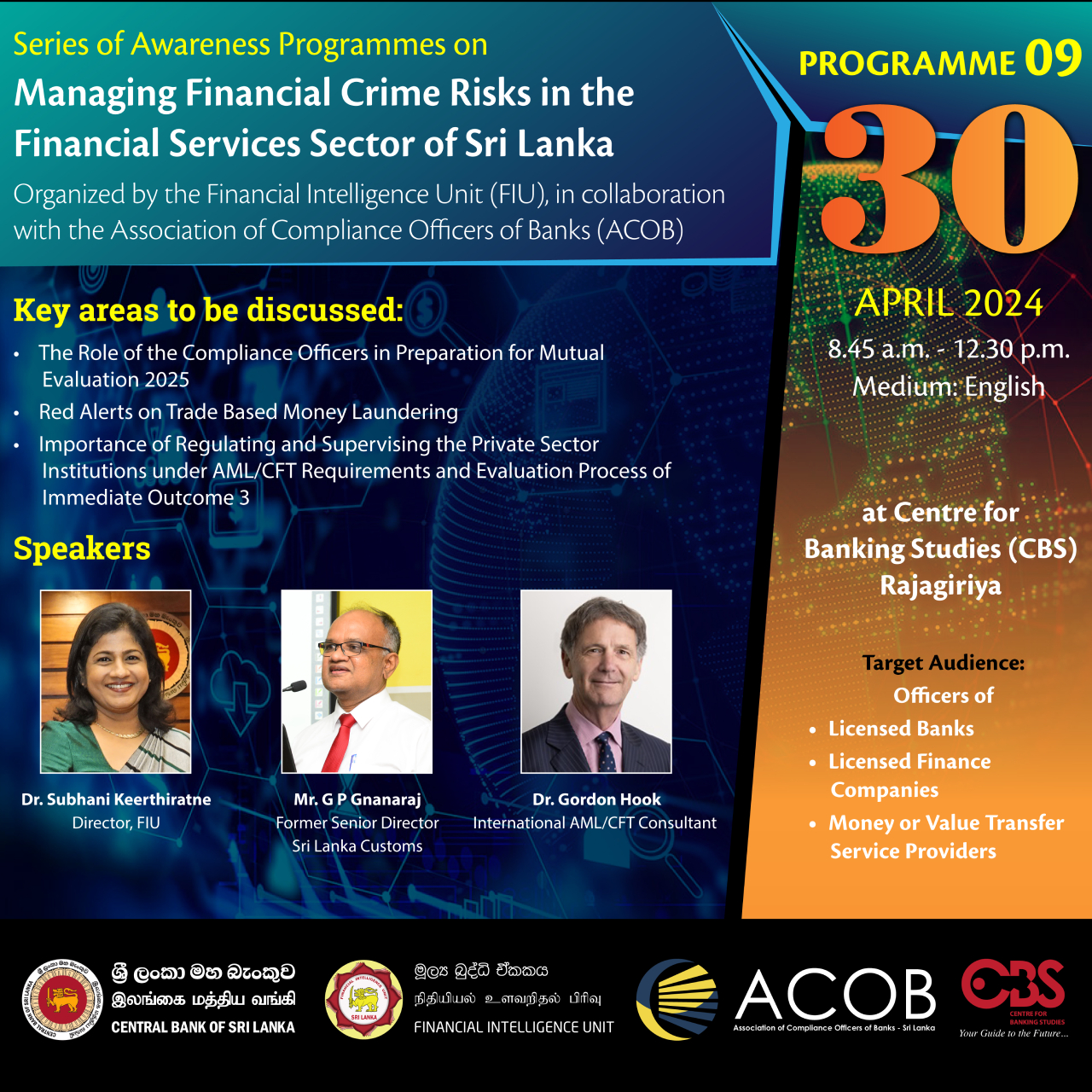

The eighteenth awareness programme on “Managing Financial Crime Risks in the Financial Services Sector of Sri Lanka”, jointly organized by the Association of Compliance Officers of Banks (ACOB) and the Financial Intelligence Unit (FIU) under the auspices of Public Private Partnership initiative, was successfully conducted for the officers of Financial Institutions (FIs) at the Central Bank of Sri Lanka, Colombo 01 on November 06, 2025.

The programme was inaugurated with the opening remarks by Dr. Subhani Keerthiratne, Director, Financial Intelligence Unit. Mrs. Theja Pathberiya, Deputy Director of FIU, Mrs. Wangeesha Karunarathna, Deputy Director of FIU and Mr. Dilan Siriwardana, Senior Assistant Director of FIU conducted sessions as resource persons. How to demonstrate the effectiveness through case studies and common issues faced by the sector were discussed during the programme.

Approximately 200 participants representing Licensed Commercial Banks, Licensed Specialised Banks, Licensed Finance Companies, Money or Value Transfer Service Providers, Primary Dealers, Insurance Companies, Stockbrokers, Insurance Regulatory Commission of Sri Lanka, Securities Exchange Commission and regulatory departments of the Central Bank of Sri Lanka participated in the programme.

Workshop on Freezing of Non-Financial Assets under Targeted Financial Sanctions - October 15, 2025

The Financial Intelligence Unit (FIU), in collaboration with the Ministry of Defence, conducted a joint workshop on 15 October 2025 for key government agencies responsible for maintaining non financial assets registries and person/entity registries.

The objective of the workshop was to strengthen the effective implementation of Targeted

Financial Sanctions (TFS) under relevant United Nations Security Council Resolutions

(UNSCRs), in line with the requirements of the Financial Action Task Force (FATF)

Recommendations 6 and 7 on Countering the Financing of Terrorism (CFT) and Proliferation

Financing (PF).

Awareness Session for Compliance Officers on Recent Trends Related to Drug Trafficking - September 30, 2025

The Financial Intelligence Unit (FIU) successfully conducted an Awareness Session on Recent Trends Related to Drug Trafficking for Compliance Officers of Licensed Banks, Licensed Finance Companies, and Money or Value Transfer Service (MVTS) Providers on 30th September 2025 at the Atrium of the Central Bank of Sri Lanka.

Organized in collaboration with the Police Narcotic Bureau (PNB), the session provided

participants with valuable insights into recent trends in drug trafficking, and best practices to adopt in reporting suspicious transactions, from a law enforcement perspective. The session commenced with opening remarks by Dr. Subhani Keerthiratne, Director of FIU. Mr. Dhammike Senarathne, Assistant Superintendent of Police attached to Police Narcotic Bureau conducted the session and Deputy Inspector General of Police in charge of Police Narcotic Range and Dr. Ayesh Ariyasinghe, Additional Director of the FIU also shared insights with the participants.

More than 150 officers from the above-mentioned financial institutions participated in the session and FIU witnessed active participation from officers across the sector, promoting enhanced compliance practices and strengthening collaboration between financial institutions and law enforcement agencies. The FIU expresses its appreciation to the PNB resource persons and all participants for contributing to the success of this awareness initiative.

Anti-Money Laundering and Countering the Financing of Terrorism (AML/CFT) Awareness Programme for Restricted Dealers in Sri Lanka - September 23, 2025

The Anti-Money Laundering/Countering the Financing of Terrorism (AML/CFT) Awareness Programme for Restricted Dealers (RDs) in Sri Lanka was successfully conducted on September 23, 2025, at the Atrium, Central Bank of Sri Lanka. The programme was organized by the Department of Foreign Exchange (DFE) in collaboration with the Financial Intelligence Unit

(FIU).

The session commenced with welcome remarks by Mr. Sudath Prasanna, Director, DFE, who

emphasized the importance of ensuring compliance with AML/CFT requirements in money changing operations

The technical session was conducted by Mrs. Theja Pathberiya, Deputy Director, FIU, who

focused on the key observations and recommendations for the sector. She provided practical guidance on how the sector should strengthen its overall AML/CFT and the upcoming Mutual Evaluation.

Capacity Building Programme Conducted for AML/CFT Regulatory/Supervisory Staff - September 15 - 19, 2025

Capacity Biulding Programme for Anti-Money Laundering/Countering the Financing of Terrorism (AML/CFT) Regulatory/Supervisory Staff was conducted from September 15 to 19, 2025, at the Centre for Banking Studies. The workshop was specifically designed for sector regulators and supervisors in relation to AML/CFT supervision. The programme brought together AML/CFT supervisors from the Financial Intelligence Unit (FIU), Bank Supervision Department (BSD), Department of Supervision of Non-Bank Financial Institutions (DSNBFI), Department of Foreign Exchange (DFE), and Payment and Settlement Department (PSD) of the Central Bank of Sri Lanka (CBSL), as well as from the Insurance Regulatory Commission of Sri Lanka (IRCSL) and the Securities and Exchange Commission of Sri Lanka (SEC).

The insightful sessions, enriched with international best practices, were facilitated by

Ms. Amanda Wood, Managing Director and Head of AML Advisory for Kroll Australia and the South Pacific as the resource person. Mr. Rishi Doshi, Vice President at Kroll, assisted in the sessions.

Altogether 42 officers representing financial sector regulators /supervisors including FIU participated in the workshop, demonstrating strong engagement and collaboration throughout, which fostered knowledge sharing, professional development, and a meaningful, impactful learning experience.

Sector Led High Level Discussion on Mutual Evaluation Preparation for the Banking Sector - September 09, 2025

A sector led high level discussion on mutual evaluation preparation for the banking sector was jointly organized by Sri Lanka Banks' Association (SLBA) and the Association of Compliance Officers of Banks (ACOB) together with the Financial Intelligence Unit of the Central Bank of Sri Lanka under the auspices of Public Private Partnership initiative. The programme was conducted for the chief executive officers, heads of business, heads of operations and compliance officers of licensed banks, at the Auditorium of Commercial Bank Ceylon PLC on September 09, 2025. Around 120 participants took part in the programme.

The programme was inaugurated with the opening remarks by Dr. Subhani Keerthiratne, Director, Financial Intelligence Unit on Sri Lanka's preparation for the upcoming mutual evaluation - 2026. Key concerns on the banking sector in relation to Mutual Evaluation preparedness was highlighted by Dr. Ayesh Ariyasinghe, Additional Director, Financial Intelligence Unit. The banking sector led initiatives to address such concerns were presented by Mrs. Manique Bandara, Chief Compliance Officer, HSBC.

Ensuing discussions highlighted the high-level commitment from the banking sector to further strengthen its AML/CFT preparedness and proactive measures to be carried out to ensure that Sri Lanka successfully faces the Mutual Evaluation - 2026.

Awareness Programme on Anti Money Laundering and Countering the Financing of Terrorism (AML/ CFT) for the Senior Management of the Sri Lanka Insurance Corporation Life Limited - September 04, 2025

An awareness programme on “Anti Money Laundering and Countering the Financing of Terrorism”, organized by the Compliance Department of the Sri Lanka Insurance Corporation Life Limited (SLIC), was successfully conducted for the senior management including the Chairman and the Board of Directors of SLIC in September

2025 at the Auditorium, SLIC. The primary objective of the programme was to provide

a clear understanding for the senior management on AML/ CFT laws and other relevant laws and regulations, with a special focus on their practical applications. Around 80 participants representing the senior managerial level of SLIC took part in

the programme.

The programme was inaugurated with the welcome speech by Ms. Subhashi Jayasumana, Acting Compliance Officer of SLIC Life Ltd. Dr. Subhani Keerthiratne, Director, Financial Intelligence Unit (FIU) conducted the awareness session.

Ms. Theja Pathberiya, Deputy Director, FIU, Ms. Hashini Rangika, Senior Assistant

Director, FIU and Ms. Subodha Weerasuriya, Assistant Director, FIU were also

present at the occasion. The session concluded with the remarks of Ms. Namalee Silva, Chief Business Officer – Life/ Acting Chief Executive Officer of SLIC.

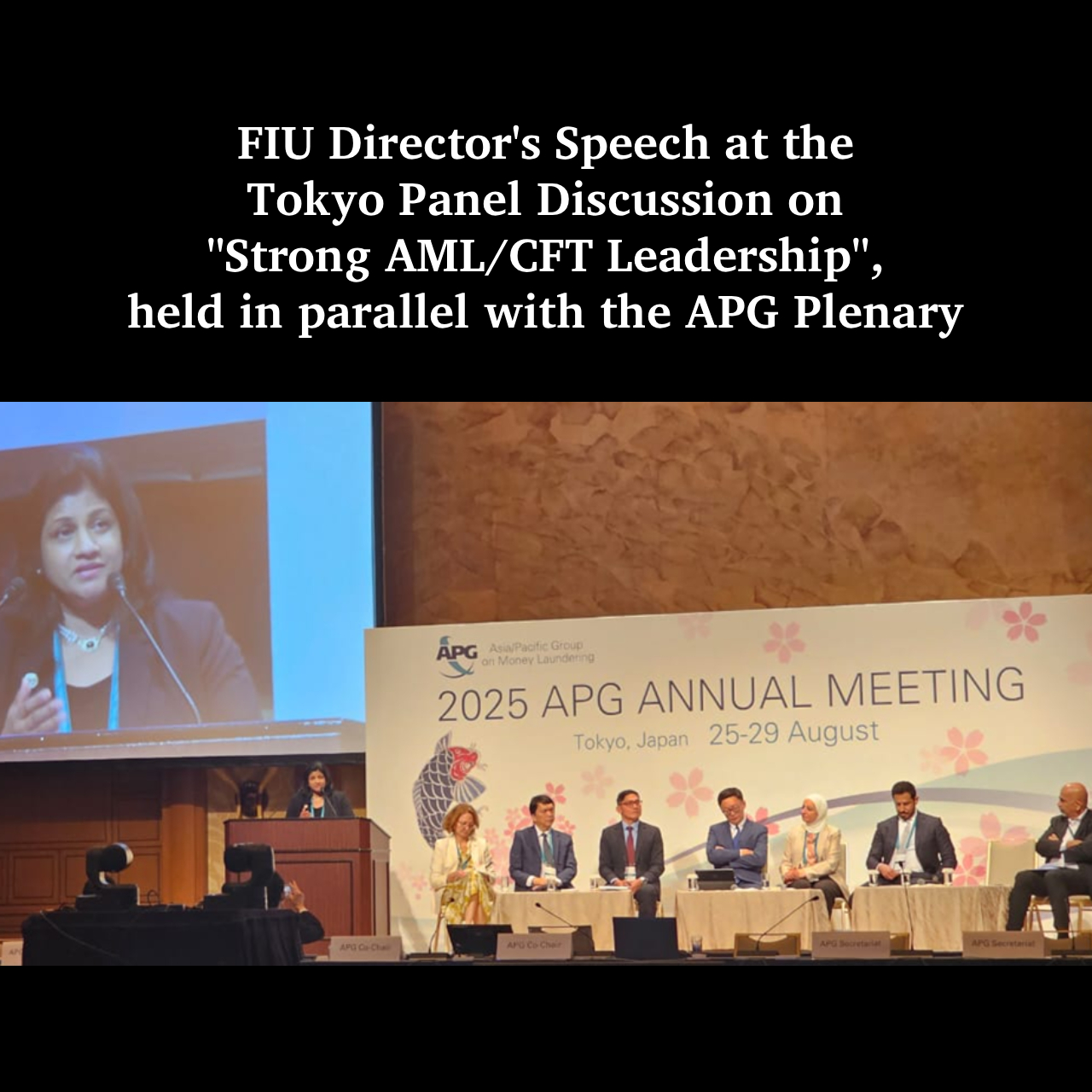

FIU Director's Speech at the Tokyo Panel Discussion on "Strong AML/CFT Leadership", held in parallel with the APG Plenary - August 27, 2025

At the Tokyo panel discussion on “Strong AML/CFT Leadership” (August 27, 2025), held in parallel with the APG Plenary from August 25–29, Dr. Subhani Keerthiratne, Director of the FIU Sri Lanka, spoke on the country’s preparation for the upcoming Global 5th Round Mutual Evaluation. She highlighted that Sri Lanka will be one of the first APG-only members to undergo this new round of assessments.

In her remarks, Dr. Keerthiratne stressed the importance of leadership and strong coordination across agencies, noting that Sri Lanka has taken steps to align with FATF standards and strengthen its AML/CFT regime. She explained that the preparation process involves not just technical compliance but also ensuring that all stakeholders—from regulators and law enforcement to policymakers—are engaged and working toward common objectives.

She emphasized that the evaluation is not merely about “ticking boxes” or compliance on paper, but about showing tangible results that reflect the effectiveness of Sri Lanka’s system in mitigating money laundering and terrorist financing risks. Dr. Keerthiratne underlined that visionary leadership, clear direction, and sustained political commitment are central for the mutual evaluation preparation of Sri Lanka.

Awareness Programme on “Anti-Money Laundering and Countering the Financing of Terrorism (AML/CFT) Compliance Obligations for the Gem and Jewellery Sector” - August 15, 2025

The National Gem and Jewellery Authority (NGJA) has organised the “Gem City, Ratnapura” – an International Gem and Jewellery Exhibition at Silver Ray Hotel, Ratnapura from August 15 to 17, 2025, bringing together a large number of dealers and stakeholders from the sector. The Financial Intelligence Unit (FIU) of Sri Lanka was invited to conduct an Awareness Programme on AML/CFT compliance obligations for the Gem and Jewellery sector on the inaugural day of the exhibition.

Accordingly, a panel discussion on AML/CFT compliance was conducted as part of the programme, with the participation of Mr. Sanjeewa Guruge, Deputy Director of the FIU. The FIU also established an Information Unit at the exhibition premises to provide continuous guidance and clarification to participants throughout the event. In addition, the FIU officials made necessary arrangements to enhance sectoral awareness. The exhibition provided an excellent opportunity for the FIU to reach a large number of dealers gathered in one place and to engage them directly on strengthening compliance practices.

The FIU’s active participation in this international exhibition emphasized its close collaboration with the sector regulator, NGJA and the continued commitment to working closely with Designated Non-Financial Businesses and Professions (DNFBPs), including the gem and jewellery sector, in building a more effective national AML/CFT framework.

Awareness Session on Anti-Money Laundering and Countering the Financing of Terrorism (AML/CFT) for the Securities Sector - August 14, 2025

The Securities and Exchange Commission of Sri Lanka (SEC), in collaboration with the Financial Intelligence Unit (FIU), conducted an awareness session on Anti-Money Laundering and Countering the Financing of Terrorism (AML/CFT) for Registered Investment Advisers from Market Intermediaries

The session was held on August 14, 2025, at the Auditorium of the Centre for Banking Studies, Central Bank of Sri Lanka, with the participation of approximately 120 attendees. The objective of the session was to equip participants with the knowledge and tools required to identify and mitigate risks associated with Money Laundering (ML) and Terrorist Financing (TF).

The event commenced with a keynote address by Dr. (Mrs.) Subhani Keerthiratne, Director of the FIU, who emphasized the importance of compliance with AML/CFT obligations. This was followed by a presentation on the legal framework for AML/CFT and the identification of suspicious transactions by Dr. Ayesh Ariyasinghe. The session concluded with a discussion on the practical aspects of Customer Due Diligence and Targeted Financial Sanctions, delivered by Mrs. Theja Pathberiya, Deputy Director of the FIU.

Awareness Programmes on Enhancing the Quality of Suspicious Transaction Reporting through Feedback - July 16 & 17, 2025

Two awareness programmes on enhancing the quality of Suspicious Transaction Reports (STR) through feedback were successfully conducted for Licensed Commercial Banks (LCBs), Licensed Specialized Banks (LSBs), Licensed Finance Companies (LFCs), Money or Value Transfer Services (MVTS) Providers on July 16, 2025 and Insurance Companies (ICs), Primary Dealers (PDs) and Stockbrokers (SBs) on July 17, 2025 by the Financial Intelligence Unit (FIU) at the Centre for Banking Studies, Rajagiriya.

Approximately 178 participants including Compliance Officers and other officials representing the aforementioned Reporting Institutions (RIs), took part in both programmes. The objective of the programmes was to provide insights into the STR reporting obligations, highlight the risks of non-reporting, and most importantly to provide feedback on the STRs reported by the RIs to encourage them to report quality STRs, ultimately aiming to improve national compliance standards.

Dr. (Mrs.) Subhani Keerthiratne, Director of the FIU, delivered the opening remarks emphasizing the STR reporting responsibilities of RIs and providing insights into the upcoming Mutual Evaluation (ME). Mr. Chandima Bandara, Mr. Dilan Siriwardana, Mr. Ayoj Induranga, and Mr. Supun Gunasekara, Senior Assistant Directors of the FIU, served as resource persons during the sessions.

Awareness Programme on “Anti-Money Laundering and Countering the Financing of Terrorism (AML/CFT)” for Officers of National Gem and Jewellery Authority ) - July 01, 2025

An awareness programme on “Anti-Money Laundering and Countering the Financing of Terrorism” was successfully conducted by the National Gem and Jewellery Authority (NGJA) on July 1, 2025, at the NGJA Head Office premises in Colombo. The session was organized with the objective of enhancing the understanding and compliance of NGJA officers with AML/CFT obligations.

The Financial Intelligence Unit (FIU) of Sri Lanka extended its support by providing

experienced resource personnel to lead the session and shared valuable insights into

AML/CFT regulations and best practices. The programme was attended by the officials

of the NGJA including the senior management, regional managers, enforcement officers

and other relevant officials.

Dr. Ayesh Ariyasinghe, Additional Director, Mr. Sanjeewa Guruge, Deputy Director, Ms.

Maheshi Perera, Senior Assistant Director, Ms. Malsha Rathnayake, Senior Assistant

Director and Ms. Janani Dayarthna, Legal Officer from FIU, joined the programme as

resource persons.The session concluded with a Q&A segment, providing participants an

opportunity to address their queries and gain further clarity on AML/CFT requirements.

This initiative marked a continued effort to strengthen the collaboration between the FIU

and NGJA in safeguarding the integrity of the Gem and Jewellery sector through effective

compliance practices.

Managing Financial Crime Risks in the Financial Services Sector of Sri Lanka (Programme 16) - June 26, 2025

The sixteenth awareness programme on “Managing Financial Crime Risks in the Financial Services Sector of Sri Lanka”, jointly organized by the Association of Compliance Officers of Banks (ACOB) and the Financial Intelligence Unit (FIU), was successfully conducted for the officers of Financial Institutions (FIs) at the Central Bank of Sri Lanka, Colombo 01 on June 26, 2025.

Mr. Jairam Manglani, Head - Financial Crime Compliance, Standard Chartered Bank - India and South Asia and Mr. Jayesh Kadam, Director - Financial Crime Compliance, Standard Chartered Bank India conducted sessions as resource persons.

The programme was inaugurated with the welcome remarks by Dr. Subhani Keerthiratne, Director, Financial Intelligence Unit. Mrs. Enoka Mohotty, Assistant Governor of the Central Bank graced the occasion.

Approximately 220 participants representing Licensed Commercial Banks, Licensed Specialised Banks, Licensed Finance Companies, Money or Value Transfer Service Providers, Primary Dealers, Insurance Companies, Stockbrokers participated in the programme.

Knowledge Sharing Session for Supervisors of Financial Institutions - June 25, 2025

A knowledge sharing session for Supervisors of Financial Institutions, organized by the Financial Intelligence Unit (FIU) in collaboration with the Standard Chartered Bank, Sri Lanka was successfully conducted on Wednesday, June 25, 2025, at the Centre for Banking Studies, Rajagiriya.

The session was conducted by Mr. Jairam Manglani, Head - Financial Crime Compliance, Standard Chartered Bank India & South Asia and Mr. Jayesh Kadam, Director - Financial Crime Compliance, Standard Chartered Bank India. The programme was inaugurated with the welcome remarks by Dr. Subhani Keerthiratne, Director, Financial Intelligence Unit.

Participants from Securities and Exchange Commission of Sri Lanka, Insurance Regulatory Commission of Sri Lanka and the supervisory departments of the Central Bank of Sri Lanka, i.e. Bank Supervision Department, Department of Supervision of Non-Bank Financial Institutions, Department of Foreign Exchange, Payments and Settlements Department and the Financial Intelligence Unit attended the programme.

Awareness Programme on Anti Money Laundering and Countering the Financing of Terrorism (AML/CFT) Compliance Obligations for Insurance Brokers - June 04, 2025

An awareness programme on “Anti Money Laundering and Countering the Financing of Terrorism Compliance Obligations for Insurance Brokers”, jointly organized by the Insurance Regulatory Commission of Sri Lanka and the Financial Intelligence Unit, was successfully conducted for the principal officers of Insurance Brokering Companies at the Centre for Banking Studies, Rajagiriya on June 04, 2025. Around 120 participants representing 82 Insurance Brokering Companies took part in the

programme.

The programme was inaugurated with the welcome speech by Ms. Damayanthi Fernando, Director General, Insurance Regulatory Commission of Sri Lanka. Dr. Ayesh Ariyasinghe, Additional Director, Financial Intelligence Unit delivered the introductory remarks.

Ms. Theja Pathberiya, Deputy Director, Financial Intelligence Unit and Ms. Thushari

Wijegunawardana, Assistant Director – AML/ CFT addressed the session as resource

persons. The session concluded with the remarks of Mr. G Rajan Nirubasingham, Director –

Legal and Enforcement, Insurance Regulatory Commission of Sri Lanka.

FIU Sri Lanka Engages at the Octopus Conference, T-CY Plenary, and GLACY-e Hub Meeting in Strasbourg - June 02 - 06, 2025

The Director of the Financial Intelligence Unit (FIU) of Sri Lanka participated in three major international events on cybercrime and digital asset investigations held in Strasbourg, France from 2 to 6 June 2025: the 32nd Plenary of the Cybercrime Convention Committee (T-CY), the Octopus Conference, and the GLACY-e Regional Workshop for Asia.

The Director / FIU contributed to the session on Crypto-investigations: Application of the Budapest Convention and the Second Additional Protocol as a panelist, where she shared insights on the practical challenges and strategic approaches in digital asset investigations from an FIU perspective.

Additionally, Director co-moderated the GLACY-e Regional Workshop for Asia on Enhancing the Role of Women in the Fight Against Cybercrime, held as part of the GLACY-e initiative. Commencing this workshop, Director presented the experience of Sri Lanka in integrating gender sensitivity in investigating cybercrime and financial crimes. Sri Lanka co-hosted this session as the designated GLACY-e hub country for Asia, alongside the Philippines.

The Director also represented Sri Lanka at the 32nd T-CY Plenary, where discussions focused on strengthening international cooperation under the Budapest Convention, with a special emphasis on the Second Protocol on electronic evidence and the growing role of virtual assets in cybercrime.

Awareness Session on Sri Lanka’s Third Mutual Evaluation for Commissioners and Senior Management of the Securities and Exchange Commission and Senior Management of the Colombo Stock Exchange - May 30, 2025

An awareness session on Sri Lanka’s upcoming 3rd Mutual Evaluation (ME) was successfully conducted by the Securities and Exchange Commission of Sri Lanka (SEC), in collaboration with the Financial Intelligence Unit (FIU), on May 30, 2025, at the SEC Auditorium.

The session was attended by the Commissioners and Senior Management of the SEC, as well as senior management of the Colombo Stock Exchange (CSE), with approximately 25 participants in total. The resource person for the session was Dr. (Mrs.) Subhani Keerthiratne, Director of the FIU, with the participation of Mrs. Theja Pathberiya, Deputy Director of the FIU.

This session formed part of the broader national efforts to enhance awareness and institutional preparedness in advance of Sri Lanka’s upcoming ME and to reinforce the SEC’s critical role in ensuring compliance with AML/CFT requirements.

Awareness Session on AML/CFT for the Securities Sector - May 27, 2025

The Securities and Exchange Commission of Sri Lanka (SEC), in collaboration with the Financial Intelligence Unit (FIU), conducted an awareness session on Anti-Money Laundering and Countering the Financing of Terrorism (AML/CFT) for Compliance Officers of Stockbrokers, Margin Providers, Investment Managers, and Collective Investment Managers/Unit Trusts, as well as Investment Advisors from Stockbrokers.

The session was held on May 27, 2025, at the Auditorium of the Centre for Banking Studies, Central Bank of Sri Lanka, with the participation of approximately 325 attendees. The objective of the session was to equip participants with the knowledge and tools required to identify and mitigate risks associated with Money Laundering (ML) and Terrorist Financing (TF).

The event commenced with a keynote address by Dr. (Mrs.) Subhani Keerthiratne, Director of the FIU, who emphasized the importance of compliance with AML/CFT obligations. This was followed by a presentation on the legal framework for AML/CFT and the identification of suspicious transactions by Dr. Ayesh Ariyasinghe. The session concluded with a discussion on the practical aspects of Customer Due Diligence and Targeted Financial Sanctions, delivered by Mrs. Theja Pathberiya, Deputy Director of the FIU.

Knowledge Transfer Session on Supervision by Financial Intelligence Unit (FIU) to Securities and Exchange Commission (SEC) Supervision Team - May 26, 2025

A knowledge transfer session on supervisory practices was conducted by the FIU for the supervision team of the Securities and Exchange Commission of Sri Lanka (SEC) on May 26, 2025, at the SEC premises.

The session was aimed at sharing key supervisory methodologies, tools, and practical insights used by the FIU in monitoring Anti-Money Laundering and Countering the Financing of Terrorism (AML/CFT) compliance. It supported capacity-building efforts and enhanced coordination between the two regulatory bodies.

The session was conducted by Mrs. Theja Pathberiya, Deputy Director of the FIU, and Mrs. S. M. H. Rangika, Head of the Supervision Division, FIU. The session was focused on the risk-based supervision approach, examination procedures, and the importance of consistent enforcement across sectors.

This initiative marks a step forward in strengthening inter-agency collaboration and aligning supervisory frameworks to improve AML/CFT oversight across the financial sector.

Awareness Session on Stockbroker and Central Depository Systems (CDS) Operations for Financial Intelligence Unit (FIU) Staff

A knowledge-sharing session on Stockbroker Operations and CDS Operations was successfully conducted by the SEC for the staff of the FIU recently, at the SEC Auditorium.

The session aimed to enhance the FIU’s understanding of stockbrokerage practices and CDS-related functions, particularly in the context of supervisory and investigative responsibilities under the Anti-Money Laundering and Countering the Financing of Terrorism (AML/CFT) framework.

The key resource persons for the session were Mr. Gihan Cooray, CEO of NDB Stockbrokers (Pvt) Ltd and President of the Colombo Stockbrokers Association, and Mr. Nadeera Athukorala, Head of the CDS.

The session provided valuable insights into operational processes, transaction flows, and regulatory obligations relevant to market intermediaries. It served as a vital step in strengthening inter-agency collaboration and aligning supervisory approaches between the FIU and the SEC.

Awareness Programme on “Anti Money Laundering and Countering the Financing of Terrorism (AML/CFT) Compliance Requirements”, for Gem and Jewellery Dealers - March 24, 2025

An awareness session on “Anti Money Laundering and Countering the Financing of Terrorism (AML/CFT) Compliance Requirements”, was successfully conducted for Gem and Jewellery Dealers during a visit to Kandy. The visit was organized by the Financial Intelligence Unit (FIU) in collaboration with the National Gem and Jewellery Authority (NGJA), in Sri Pushpadana Society Limited, Kandy on March 24, 2025.

Gem and Jewellery dealers representing the private institutions of the Gem and Jewellery sector and officers from the National Gem and Jewellery Authority participated in the programme. The main objective of the session was to enhance understanding of AML/CFT regulatory requirements, promote the best practices, and mitigate money laundering and terrorist financing risks within the industry.

During the visit, three onsite examinations and two spot examinations were conducted by the examiners of FIU and NGJA to ensure compliance of the sector with AML and CFT obligations.

AML/CFT Familiarization Programme for Tourist Hotels and Authorized Money Changers in Sri Lanka - February 27, 2025

The Anti-Money Laundering/Countering the Financing of Terrorism (AML/CFT) Training Programme for Restricted Dealers (RDs), specifically hotels licensed as RDs and newly licensed Money Changers in Sri Lanka, was successfully conducted by the Department of Foreign Exchange (DFE) in collaboration with the Financial Intelligence Unit (FIU) at the Central Bank of Sri Lanka on February 27, 2025.

The primary objective of the program was to enhance awareness and strengthen AML/CFT regulatory compliance among Compliance Officers of Hotels and newly licensed Money Changers. A total of 21 participants representing 10 hotels and 4 newly licensed money changers attended, highlighting the sector's collective commitment to combating financial crimes and improving compliance measures.

The session commenced with welcome remarks by Dr. (Mrs.) Sajeevani Weerasekara, Deputy Director, DFE, followed by an address from Dr. (Mrs.) Subhani Keerthiratne, Director, FIU, who emphasized the importance of compliance with AML/CFT in money changing operations.

The sessions were conducted by Mrs. A.D. Premathilaka, Senior Assistant Director, Supervision Division, FIU, and Ms. Kasuni Alahakoon, Assistant Director, Financial Data Management Division, FIU.

Additionally, Mrs. Theja Pathberiya, Deputy Director, FIU, actively engaged with participants, providing valuable insights and addressing their queries. The programme concluded with closing remarks by Dr. Weerasekara, reinforcing the importance of AML/CFT compliance in the sector.

Roadmap to AML/CFT Compliance: Anti-Money Laundering and Countering the Financing of Terrorism - February 13, 2025

An awareness programme on Anti-Money Laundering and Countering the Financing of Terrorism (AML/CFT), titled “Road Map for Achieving AML/CFT Compliance,” was successfully held on February 13, 2025, at the Central Bank of Sri Lanka. The programme was exclusively conducted for practicing members of the Institute of Chartered Accountants of Sri Lanka (ICASL), in collaboration with ICASL.

The programme aimed to enhance awareness and understanding of AML/CFT compliance obligations among Chartered Accountants who come within the legislative purview of the Financial Transaction Reporting Act, No. 6 of 2006.

The programme began with opening remarks by Dr. Subhani Keerthiratne, Director of the Financial Intelligence Unit (FIU), followed by Mr. Heshana Kuruppu, President of ICASL. Key insights on customer due diligence, identification of suspicious transactions and reporting were presented by the resource persons, Mrs. Theja Pathberiya, Deputy Director of the FIU; Mr. Kosala Harshadewa, Senior Assistant Director of the FIU; and Mr. Dilan Siriwardana, Senior Assistant Director of the FIU. Eighty-seven registered members of ICASL participated in the programme.

The programme concluded with an interactive panel discussion featuring Dr. Subhani Keerthiratne, Director of the FIU; Dr. Ayesh Ariyasinghe, Additional Director of the FIU; and Ms. Nishani Perera, Partner at Moor Aiyar. The discussion was moderated by Mr. Saman Sri Lal, Council Member and Chairman of the Professional Accountants in Practice Committee, CA Sri Lanka.

Awareness Programme on Anti-Money Laundering and Countering the Financing of Terrorism Compliance Obligations for Primary Dealers in Sri Lanka - January 24, 2025

An awareness programme on “Anti-Money Laundering and Countering the Financing of Terrorism (AML/CFT) Obligations” was successfully conducted for the Primary Dealers (PDs) in Sri Lanka on January 24, 2025, from 2.00 p.m. to 4.30 p.m. at the Central Bank of Sri Lanka (CBSL).

The programme aimed to enhance the awareness and understanding of AML/CFT compliance obligations among PDs, strengthening their adherence to regulatory requirements. Fifteen representatives from the five non-bank PDs participated in the programme.

The programme commenced with opening remarks by Dr. Subhani Keerthiratne, Director of the Financial Intelligence Unit (FIU), CBSL, followed by Dr. Thilini Kumari, Deputy Director, Department of Supervision of Non-Bank Financial Institutions (DSNBFI). Further, Ms. Theja Pathberiya, Ms. Wangeesha Karunaratne, Deputy Directors of the FIU; and Ms. Kasuni Alahakoon, Assistant Director of the FIU provided key insights and guidance as resource persons. The programme concluded with an interactive Q&A session.

Awareness Programme on Anti-Money Laundering and Countering the Financing of Terrorism Obligations (Southern Province Regional Forum) - January 10, 2025

An awareness session on “Anti-Money Laundering and Countering the Financing of Terrorism Obligations for Designated Non-Finance Businesses and Professionals” was conducted on January 10, 2025, from 2:00 p.m. to 4:00 p.m. at the Auditorium of the Regional Office of the Central Bank of Sri Lanka, Matara.

The session was conducted parallel to the Southern Province Regional Forum conducted by Central Bank of Sri Lanka, in collaboration with the Regional Office, Matara.

The programme was inaugurated by Mrs. Enoka Mohotty, Assistant Governor and keynote address was conducted the Dr. Subhani Keerthiratne, Director, Financial Intelligence Unit. Ms. Theja Pathberiya, Deputy Director and Mr. Supun Gunasekara, Senior Assistant Director of the Financial Intelligence Unit addressed the session as resource persons. The session concluded with the closing remarks by Dr. Ayesh Ariyasinghe, Additional Director, Financial Intelligence Unit.

Awareness Programme on Anti-Money Laundering and Countering the Financing of Terrorism Obligations (Southern Province Regional Forum) - January 10, 2025

An awareness programme on “Anti-Money Laundering and Countering the Financing of Terrorism Obligations” was conducted successfully for Licensed Banks (LBs) on January 10, 2025, from 9.00 a.m. to 1.00 p.m., at the Auditorium of the Bank of Ceylon, Regional Office, Matara.

The session was conducted parallel to the Southern Province Regional Forum, carried out under the leadership of the Governor of the Central Bank of Sri Lanka, in collaboration with the Central Bank Regional Office, Matara.

The awareness programme commenced with the keynote speech by Dr. Nandalal Weerasinghe, Governor of the Central Bank of Sri Lanka. Further, Ms. Theja Pathberiya, Deputy Director, Financial Intelligence Unit (FIU), Mr. Supun Gunasekara, Senior Assistant Director, and Ms. Kasuni Alahakoon, Assistant Director of the FIU addressed the session as resource persons. Ms. Enoka Mohotty, Assistant Governor of the CBSL graced the occasion with Dr. Subhani Keerthiratne, Director, FIU.

A successful and interactive panel discussion was held at the end of the session, and the participants actively participated in the discussion and shared their views. Dr. Subhani Keerthiratne, Director of the FIU, Dr. Ayesh Ariyasinghe, Additional Director and the resource persons joined the discussion as panelists.

Industry Awareness Session on Anti-Money Laundering and Countering the Financing of Terrorism - December 11, 2024

The Financial Intelligence Unit (FIU) of Sri Lanka successfully hosted its Annual High-Level Awareness Conference at the Central Bank of Sri Lanka (CBSL) drawing an impressive participation of around 275 attendees that included the Chairpersons, Boards of Directors and the Senior Management of the Licensed Commercial Banks, Licensed Specialized Banks, Licensed Finance Companies, Money or Value Transfer Service Providers and Primary Dealer institutions.

The Conference commenced with a presentation by Dr. Subhani Keerthiratne, Director of the FIU on “Strengthening Governance: Enhancing Accountability of Financial Institution’s Board of Directors/ Key Management Personnels for Effective Compliance against Money Laundering/ Terrorist Financing/ Proliferation Financing”.

The keynote address was delivered by Mr. Nihal Fonseka, member of the Governing Board of the CBSL by on “Importance of Advanced Transaction Monitoring Systems for a Financial Institution to identify Suspicious Transactions”. His insightful speech emphasized the need for robust mechanisms to monitor transactions and detect suspicious transactions.

The conference concluded with the vote of thanks delivered by Dr. Ayesh Ariyasinghe, Additional Director of the FIU, recognizing the participation and the contribution of all participants.

Industry Awareness Session on Anti-Money Laundering and Countering the Financing of Terrorism - November 06, 2024

An awareness programme on “Anti Money Laundering and Countering the Financing of Terrorism Compliance Obligations for Insurance Companies”, jointly organized by the Insurance Regulatory Commission of Sri Lanka and the Financial Intelligence Unit, was successfully conducted for the chief executive officers, compliance officers and other principal officers of Insurance Companies at the Insurance Regulatory Commission of Sri Lanka on November 06, 2024. Around 50 participants representing 17 Insurance Companies took part in the programme

The programme was inaugurated with the welcome speech by Mr. Rajan Nirubasingham, Director - Legal and Enforcement, Insurance Regulatory Commission of Sri Lanka. Dr. Subhani Keerthiratne, Director, Financial Intelligence Unit delivered the introductory remarks.

Ms. Theja Pathberiya, Deputy Director, Financial Intelligence Unit, Mr. Supun Gunasekara, Senior Assistant Director, Financial Intelligence Unit, Ms. Kasuni Alahakoon, Assistant Director, Financial Intelligence Unit, addressed the session as resource persons. The session concluded with the remarks of Mrs. Thushari Wijegunawardana, Assistant Director – AML & CFT, Insurance Regulatory Commission of Sri Lanka.

Financial Intelligence Unit of Sri Lanka entered into a Memorandum of Understanding with the National Secretariat for Non-Governmental Organizations – - November 04, 2024

The Financial Intelligence Unit (FIU) of Sri Lanka entered into a Memorandum of Understanding (MOU) with the National Secretariat for Non-Governmental Organizations on November 04, 2024 at the Central Bank of Sri Lanka (CBSL) to ) to exchange information on investigations and prosecutions of Money Laundering (ML), Terrorist Financing (TF) and related crimes and of any persons connected thereto. This MOU has been entered into by the FIU, in terms of the provisions of the Financial Transactions Reporting Act, No. 6 of 2006.

Mr. Sanjeewa Wimalagunarathna, Director General and the Registrar of the National

Secretariat for Non-Governmental Organizations, and Dr. Subhani Keerthiratne, Director

of the FIU signed the MOU on behalf of the respective institutions. The MOU was signed

in the presence of Dr. P Nandalal Weerasinghe, the Governor of the CBSL, in the capacity

as the Chairman of the Anti-Money Laundering and Countering the Financing of Terrorism

(AML/CFT) National Coordinating Committee. Mrs. K M A N Daulagala, Senior Deputy

Governor of the CBSL and Mrs. E H Mohotty, Assistant Governor of the CBSL also graced

the event.

With the signing of this MOU, the FIU has entered into 16 MOUs with domestic

government agencies, including Sri Lanka Customs, Sri Lanka Police, Department of

Immigration and Emigration, Inland Revenue Department, Department for Registration of

Persons, Excise Department of Sri Lanka, Commission to Investigate Allegations of Bribery

or Corruption, Registrar General’s Department etc., in order to share information to

strengthen the AML/CFT framework of the country. The FIU has entered into 45 MOUs

with foreign counterparts as well.

Awareness Programme on Managing Financial Crime Risks in the Financial Services Sector of Sri Lanka (Programme 14) - October 15, 2024

The fourteenth awareness programme on “Managing Financial Crime Risks in the Financial Services Sector of Sri Lanka”, jointly organized by the Association of Compliance Officers of Banks and the Financial Intelligence Unit, was successfully conducted for the chief executive officers, compliance officers and other related officers of financial institutions at the Centre for Banking Studies in Rajagiriya on October 15, 2024.

Around 130 participants representing the Licensed Commercial Banks, Licensed Specialised Banks, Licensed Finance Companies, Money or Value Transfer Service Providers and Supervisory Departments of the Central Bank of Sri Lanka, took part in the programme.

The programme was inaugurated with the welcome remarks by Dr. Subhani Keerthiratne,

Director, Financial Intelligence Unit. Further, Hon. Justice Buwaneka Aluwihare, Retired

Judge of the Supreme Court, President’s Counsel, and the Chairman of the Task force on Anti

Money Laundering and Countering the Financing of Terrorism graced the occasion.

Mr. Nitin Kataria, Director, Anti Financial Crime, Deutsche Bank, India, conducted the

session on “Engagement with FATF Evaluators: A Banker’s Experience”. The session was concluded with the remarks of Mrs. Theja Pathberiya, Deputy Director of

Financial Intelligence Unit.

Awareness Programme on “Anti Money Laundering and Countering the Financing of Terrorism (AML/CFT) Compliance Requirements”, for Gem and Jewellery Dealers - October 11, 2024

An awareness session on “Anti Money Laundering and Countering the Financing of Terrorism (AML/CFT) Compliance Requirements”, was successfully conducted for Gem and Jewellery Dealers during a visit to International Gem Trading Center, Rathnapura. The visit was organized by the Financial Intelligence Unit (FIU) in collaboration with the Export Division of National Gem and Jewellery Authority (NGJA), at Demuwawatha International Gem Trading Center, Rathnapura on October 11, 2024.

Gem and Jewellery dealers representing the private institutions of the Gem and Jewellery sector and officers from the National Gem and Jewellery Authority participated in the programme. The main objective of the session was to enhance understanding of AML/CFT regulatory requirements, promote the best practices, and mitigate money laundering and terrorist financing risks within the industry

Customer Due Diligence (CDD) Rules for Designated Non-Finance Businesses and Professions (DNFBP) sector, Suspicious Transactions Reporting (STR), tool for Targeted Financial Sanctions (TFS) screening, FATF Mutual Evaluation for Sri Lanka were among the topics discussed at the session

Awareness Session on Money Laundering (ML) and Terrorist Financing (TF) Risk Management for Licensed Finance Companies (LFCs) - October 10, 2024

An awareness programme on Money Laundering (ML) and Terrorist Financing (TF) Risk Management was conducted successfully for Licensed Finance Companies (LFCs) jointly by the Compliance Forum of the Finance Houses Association (FHA) and the Financial Intelligence Unit (FIU) at the Auditorium of the LB Finance PLC, Colombo 03 on October 08, 2024. Around 100 participants representing Compliance, Audit and Risk Management Departments of LFCs participated in the programme. The objective of the programme was to enhance the awareness of the sector on the National Risk Assessment and the theoretical and practical aspects of conducting the institutional wise ML/ TF risk assessment.

The programme commenced with welcome remarks from Ms. Zairaa Kaleel, Chairperson of the Compliance Forum of the FHA, followed by opening remarks from Mr. Roshan Abeygunasekara, Council Member of the FHA. Dr. Subhani Keerthiratne, Director of the FIU and Mrs. Chanuri Jayasinghe, Director of the Department of Supervision of Non-Bank Financial Institutions also addressed the audience, emphasizing the importance of enhancing compliance within the LFC sector.

Financial Crime Programme for Attorneys-at-Law - September 14, 2024

See More

A Financial Crime Programme for Attorneys-at-Law is to be held on September 14, 2024 from 8.00 AM to 5.00 PM, at the Kingsbury Hotel, Colombo.

Mr. Kalinga Indatissa, PC, Dr. Subhani Keerthiratne, AAL, Director of the Financial Intelligence Unit and Mr. Patrick J. Ehlers from the United States Department of Justice are to participate in the programme as resource persons.

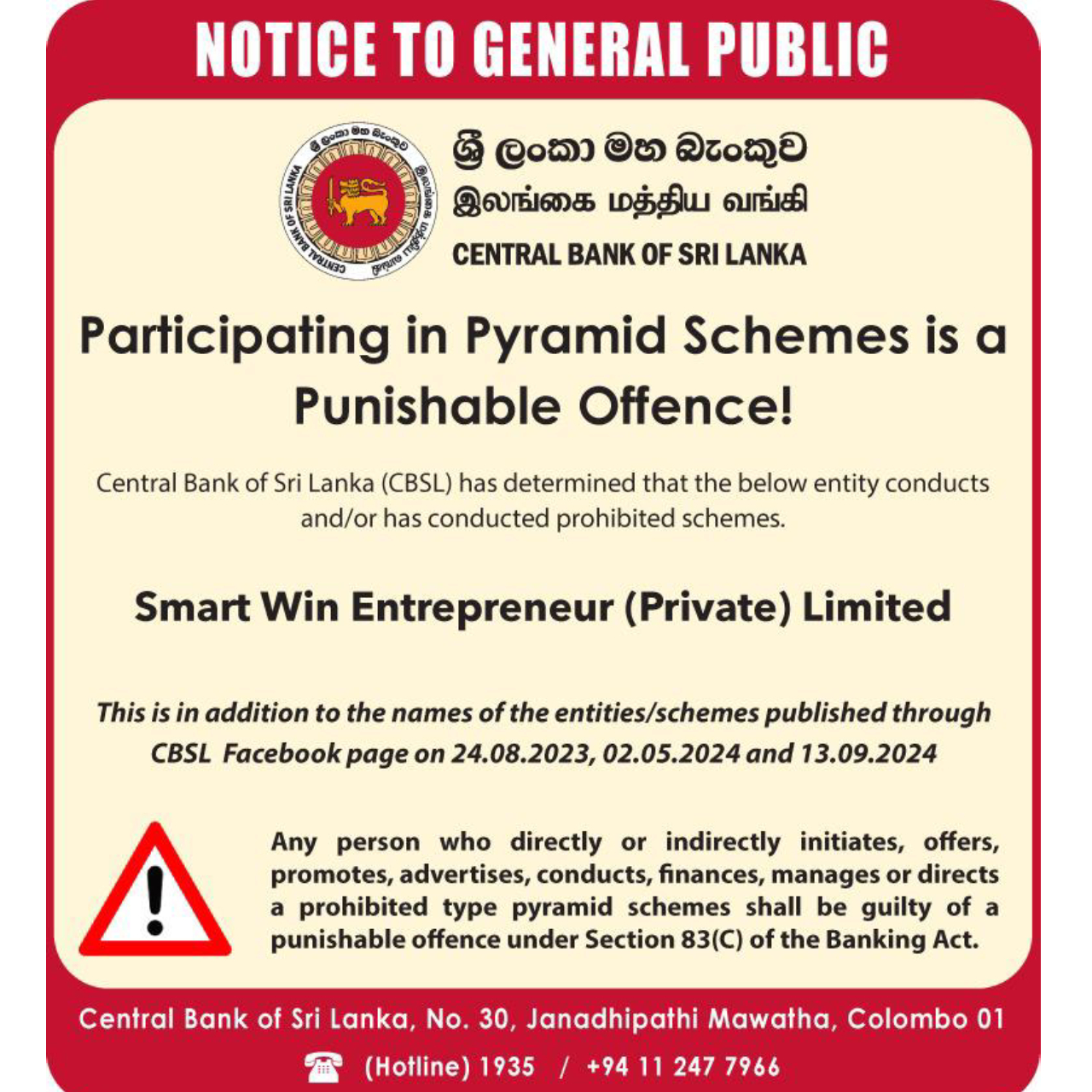

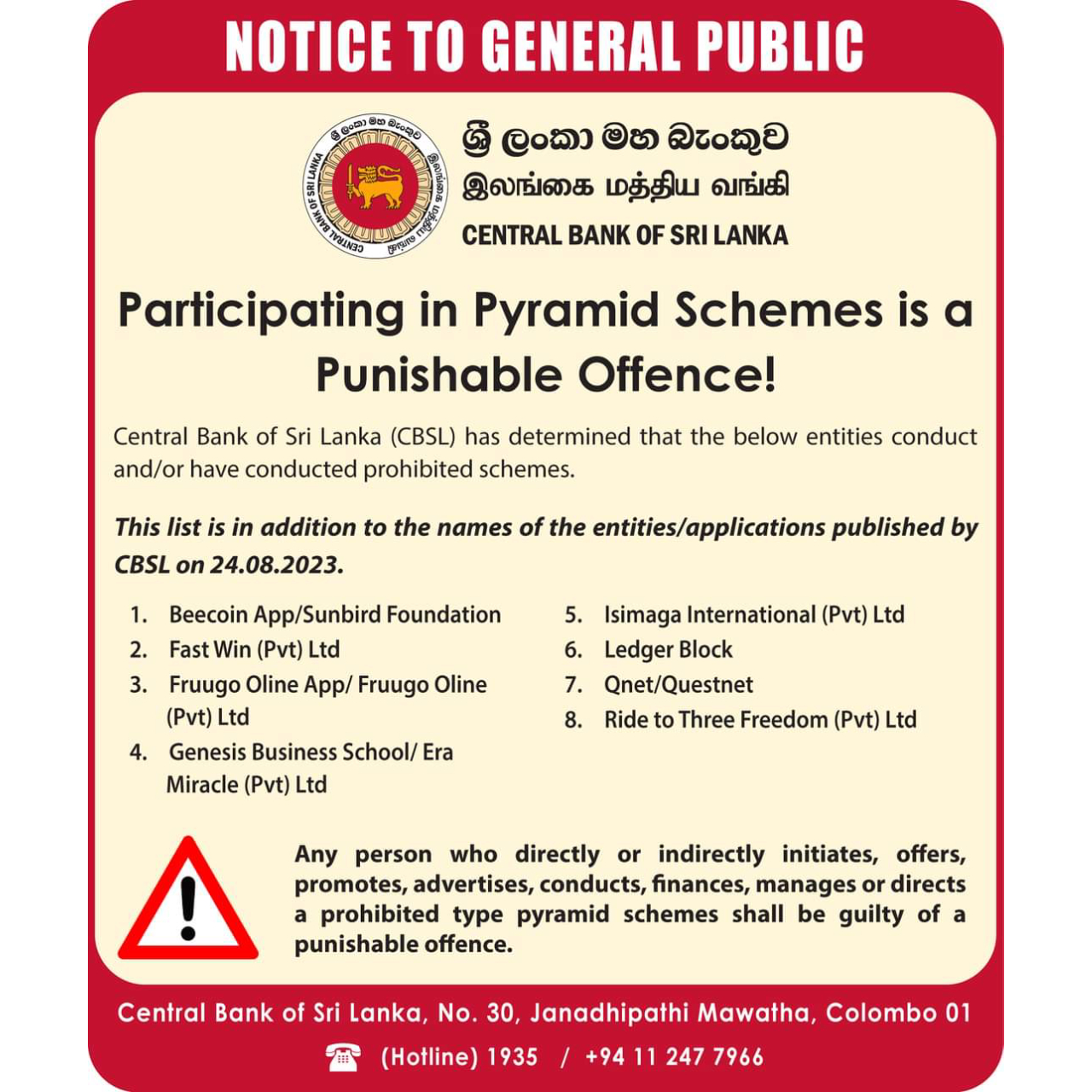

Notice to General Public: Participating in Pyramid Schemes is a Punishable Offence - October 11, 2024

The Central Bank of Sri Lanka (CBSL) has determined that 'Smart Win Entrepreneur (Privaet) Limited conduct and/or have conducted prohibited schemes, in addition to the entities /applications published by CBSL on August 24, 2023, May 02, 2024 and September 13, 2024.

Any person who directly or indirectly initiates, offers, promotes, advertises, conduct, finances, manages or directs a prohibited type pyramid schemes shall be guilty of a punishable offence.

Awareness Programme on “Anti Money Laundering and Countering Financing of Terrorism (AML/CFT)” for the officials of National Secretariat for Non-Governmental Organizations (NGOs) - September 11, 2024

An awareness session on “Anti Money Laundering and Countering Financing of Terrorism (AML/CFT)” was successfully conducted for the Officials of the National Secretariat for Non-Governmental Organizations (NSNGO) at the Centre for Banking Studies (CBS), Rajagiriya on September 11, 2024.

The Financial Intelligence Unit (FIU) has conducted this session at the request of the NSNGO with the aim of enhancing the awareness of their officials on the AML/CFT legal framework, Sri Lanka’s current compliance level in AML/CFT and emerging trends and developments related to risk of abuse of NGOs for Terrorist Financing (TF) including real world examples. Around 35 officials from the NSNGO including District Coordinators of 17 districts participated in the above awareness programme.

Dr. (Mrs.) Subhani Keerthiratne, Director of the FIU delivered the opening remarks highlighting how the NGOs can be abused for TF. Hon. Justice Buwaneka Aluwihare P.C, an officer from Army Headquarters, Mr. Nimantha Athukorala, Senior Assistant Director of the FIU and Ms. Kasuni Alahakoon, Assistant Director of the FIU addressed the sessions as resource persons. Mr. Sanjeewa Wimalagunarathna, Director General of the NSNGO delivered the concluding remarks.

Managing Financial Crime Risks in the Financial Services Sector of Sri Lanka (Programme 13) - September 11, 2024

The thirteenth awareness programme on “Managing Financial Crime Risks in the Financial Services Sector of Sri Lanka”, jointly organized by the Association of Compliance Officers of Banks (ACOB) and the Financial Intelligence Unit (FIU), was successfully conducted for the compliance officers and other related officers of financial institutions at the Centre for Banking Studies (CBS) in Rajagiriya on September 11, 2024. Around 100 participants representing Licensed Commercial Banks, Licensed Specialised Banks, Licensed Finance Companies and Money or Value Transfer Service Providers, took part in the programme.

Three resource persons from HSBC – India, namely, Mr. Vinodhkumar Parameswaran, Head of Financial Crime, Ms. Kavita Tavare, Head of Financial Crime Investigations and Mr. Praveen Dayal, Senior Vice President, Investigative Reporting shared their Mutual Evaluation experience during the first session of the programme via zoom platform, whereas Dr. Ayesh Ariyasinghe, Additional Director of Financial Intelligence Unit (FIU), Central Bank of Sri Lanka, conducted the second session of the programme on supervisory concerns identified during on-site examinations.

Training programme conducted by the U.S Department of Justice and the Federal Bureau of Investigations on ‘Fundamentals on Money Laundering for Prosecutors and Investigators - August 26 - 30, 2024

A training programme on Fundamentals of Money Laundering for Prosecutors and Investigators was conducted by the Embassy of the United States of America with the participation of officers from the Financial Intelligence Unit (FIU) and officers from other stakeholder agencies. This initiative was a collaboration between the U.S. Department of Justice and the Federal Bureau of Investigations, focusing on concepts central to a criminal investigation and successful prosecution of money laundering offences.

The five day training session featured subject experts Mr. Patrick Ehlers –Resident

Legal Advisor, U.S. Embassy, Mr. Grant Sparks – Assistant United States Attorney,

Mr. Steven Telisak – Sepcial Agent, FBI, Ms. Candice Moreno – Forensic Accountant,

FBI and Mr. David Becerra – Assistant Legal Attaché, U.S. Embassy who shared their

expertise.

Industry awareness session on Anti-Money Laundering and Countering the Financing of Terrorism (AML/CFT) - August 16, 2024

See More

An Industry awareness session on Anti-Money Laundering and Countering the Financing of Terrorism (AML/CFT) is to be held on August 16, 2024 from 9.00 AM to 12.00 PM at the Auditorium of the Securities and Exchange Commission of Sri Lanka.

The session will be focused on AML/CFT compliance, AML reporting, identification of suspicious transactions, and other AML/CFT related topics.

FIU SL enters MoU with Registrar General’s Dept. - The Daily Morning (August 12, 2024)

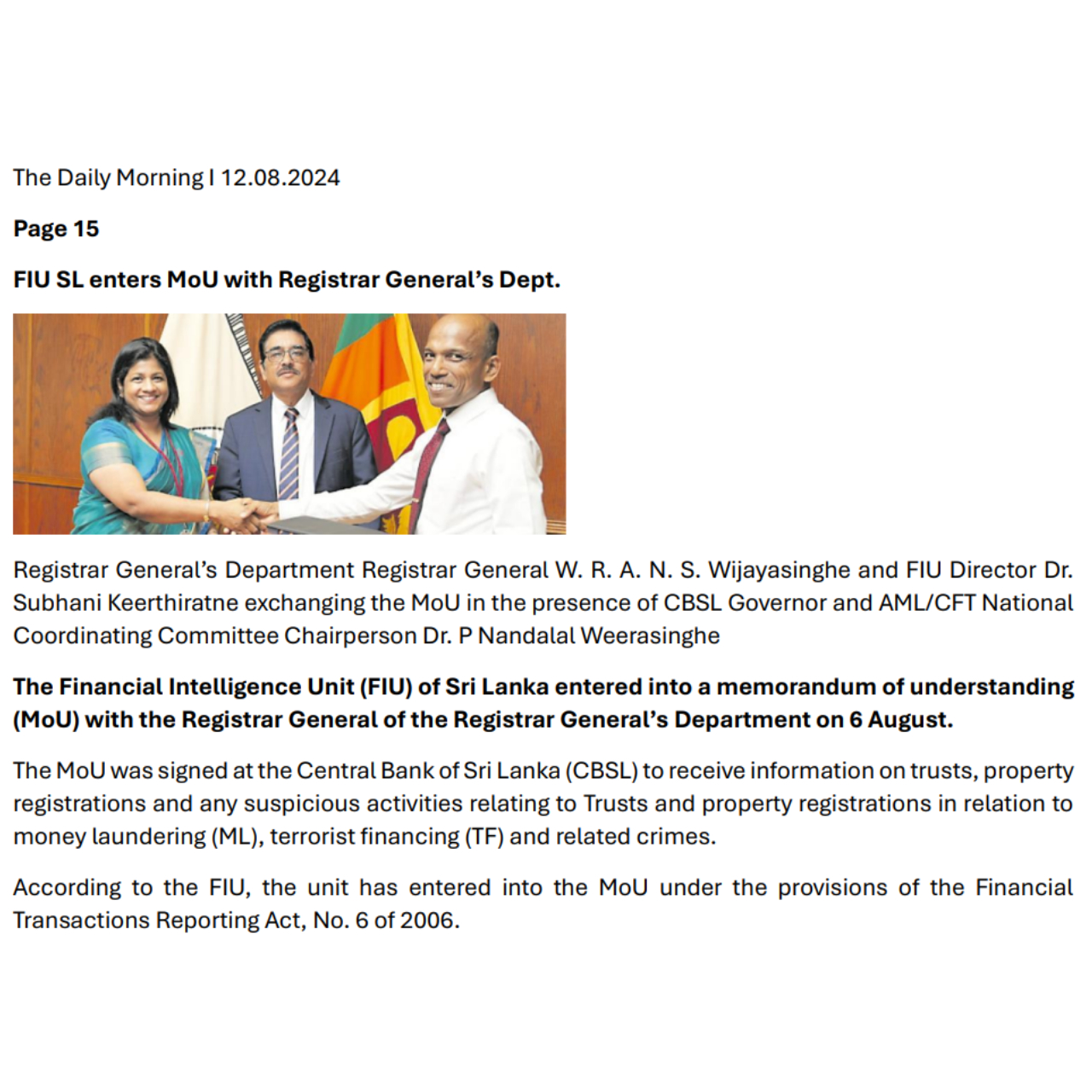

The Financial Intelligence Unit (FIU) of Sri Lanka entered into a memorandum of understanding (MoU) with the Registrar General of the Registrar General’s Department on 6 August.

The MoU was signed at the Central Bank of Sri Lanka (CBSL) to receive information on trusts, property registrations and any suspicious activities relating to Trusts and property registrations in relation to money laundering (ML), terrorist financing (TF) and related crimes. According to the FIU, the unit has entered into the MoU under the provisions of the Financial Transactions Reporting Act, No. 6 of 2006.

Registrar General’s Department Registrar General W. R. A. N. S. Wijayasinghe and FIU Director Dr. Subhani Keerthiratne signed the MoU on behalf of the respective institutions. It was signed in the presence of CBSL Governor Dr. P Nandalal Weerasinghe, in the capacity as the Chairperson of the Anti-Money Laundering and Countering the Financing of Terrorism (AML/CFT) National Coordinating Committee, and CBSL Assistant Governor E. H. Mohotty.

This MoU will facilitate Registrar General’s Department to provide information to the FIU relating to trusts, property registrations and any suspicious activities, which will be vital for prevention, detection and prosecution of ML/TF and related crimes.

CBSL's FIU Ties up with Registrar Genral's Dept - Daily News (August 12, 2024)

The Central Bank’s Financial Intelligence Unit (FIU) has entered into an MoU with the Registrar General’s Department to enable them to obtain information regarding any suspicious trusts and property registrations taking another step forward to prevent money laundering, terrorism financing and related crimes.

The Financial Intelligence Unit will be facilitated to obtain relevant information regarding trusts, registrations and any related suspicious activities directed to the Registrar General’s Department.

The Financial Intelligence Unit, being able to obtain such information is vital for the prevention, detection, investigation and prosecution of money laundering, terrorist financing and related crimes.

The Central Bank’s Financial Intelligence Unit Director Dr.Subhani Keerthiratne and Registrar General W.R.A.N.S.T. Wijayasinghe signed the MoU on behalf of their respective organisations.

Click Here to View the Newspaper Article

FIU SL-Registrar General Partner to Track Money Laundering via Trusts - Daily Mirror Online (August 10, 2024)

Sri Lanka’s Financial Intelligence Unit (FIU) has partnered with the Registrar General’s Department to monitor trusts and property registrations for the potential money laundering activities.

The collaboration, formalised through a memorandum of understanding (MoU) on August 6, 2024, grants the FIU access to relevant data, enhancing efforts to combat money laundering and terrorist financing (ML/TF) and related crimes. This MoU has been entered into by the FIU, in terms of the provisions of Financial Transactions Reporting Act No. 6 of 2006.

Registrar General’s Department Registrar General W.R.A.N.S. Wijayasinghe and FIU Director Dr. Subhani Keerthiratne signed the MoU on behalf of the respective institutions. The MoU was signed in the presence of Central Bank Governor Dr. P. Nandalal Weerasinghe, in the capacity of Anti-Money Laundering and Countering Financing of Terrorism (AML/CFT) National Coordinating Committee Chairman and Central Bank Assistant Governor E.H. Mohotty also attended the event.

Click Here to View the Newspaper Article

Awareness Programme for Real Estate Sector and Gem & Jewellery Dealers - August 08, 2024

An awareness session on “Anti Money Laundering and Countering the Financing of Terrorism (AML/CFT)” Compliance Requirements”, was successfully conducted for the Real Estate Sector and Gem and Jewellery Dealers. The session was organized by the Financial Intelligence Unit (FIU), at the Centre for Banking Studies (CBS) in Rajagiriya on August 08, 2024.

About 80 participants from the Real Estate sector and Gem and Jewellery sector representing private institutions and officers from the National Gem and Jewellery Authority participated in the programme.

Mr. A A M Thassim, Deputy Governor of Central Bank of Sri Lanka delivered the opening remarks at the programme and highlighted the importance of compliance for both these sectors as critically important. Mrs. Theja Pathberiya, Deputy Director of Financial Intelligence Unit of Central Bank of Sri Lanka, Mr. Mahinda Jayasundara, Chief Inspector of Police, Criminal Investigations Department, Mr. Kosala Harshadewa, Senior Assistant Director of Financial Intelligence Unit of Central Bank of Sri Lanka, Mr. Supun Gunasekara, Senior Assistant Director of Financial Intelligence Unit of Central Bank of Sri Lanka and Mrs. Chaya Gunarathna, Compliance Officer of Seylan Bank PLC., addressed the sessions as resource persons. Dr. Ayesh Ariyasinghe, Additional Director of Financial Intelligence Unit of Central Bank of Sri Lanka, delivered the concluding remarks.

Financial Intelligence Unit of Sri Lanka entered into a Memorandum of Understanding with the Registrar General of the Registrar General’s Department - August 06, 2024

The Financial Intelligence Unit (FIU) of Sri Lanka entered into a Memorandum of Understanding (MOU) with the Registrar General of the Registrar General’s Department on August 06, 2024 at the Central Bank of Sri Lanka (CBSL) to receive information on Trusts, property registrations and any suspicious activities relating to Trusts and property registrations in relation to Money Laundering (ML), Terrorist Financing (TF) and related crimes. This MOU has been entered into by the FIU, in terms of the provisions of the Financial Transactions Reporting Act, No. 6 of 2006.

Mr. W R A N S Wijayasinghe, Registrar General of the Registrar General’s Department, and Dr. Subhani Keerthiratne, Director of the FIU signed the MOU on behalf of the respective institutions. The MOU was signed in the presence of Dr. P Nandalal Weerasinghe, the Governor of the CBSL, in the capacity as the Chairman of the Anti-Money Laundering and Countering the Financing of Terrorism (AML/CFT) National Coordinating Committee, and Mrs. E H Mohotty, an Assistant Governor of the CBSL, also attended the event.

With the signing of this MOU, the FIU has entered into 15 MOUs with domestic government agencies, including Sri Lanka Customs, Sri Lanka Police, Department of Immigration and Emigration, Inland Revenue Department, Department for Registration of Persons, Excise Department of Sri Lanka, Commission to Investigate Allegations of Bribery or Corruption, etc., in order to share information to strengthen the AML/CFT framework of the country. The FIU has entered into 45 MOUs with foreign counterparts as well.

Seminar on Implications of Money Laundering and Terrorist Financing on the National Economy and the Country - August 05, 2024

A seminar on implications of Money Laundering & Terrorist Financing on the national economy and the country, organized by the National Issues Committee of the Organisation of Professional Associations of Sri Lanka (OPA), is to be held on August 05, 2024 from 6.00 PM onwards at the Auditorium of the OPA.

Hon. Justice Buwaneka Aluwihare, P.C., Dr. (Mrs.) Subhani Keerthiratne, Director, Financial Intelligence Unit of Sri Lanka, Mr. Sarath Gamage, President of OPA are to address the programme and share their expertise. The seminar is to be moderated by Mr. Bhanu Wijayaratne, Chairman of the National Issues Committee, Vice President of OPA.

Financial Crime Programme for Attorneys - August 03, 2024

A programme of Financial Crime, for Attorneys, organised by the Conference and Seminar COmmittee of Colombo Law Society, is to be held on August 03, 2024 from 8.00 AM to 5.00 PM at Cinnamon Lakeside, Colombo.

Mr. Kalinga Indatissa, P.C., Dr. (Mrs.) Subhani Keerthiratne, Director of the Financial Intelligence Unit and Mr. Patrick J. Ehlers, from the United States Department of Justice are to be joining the seminar to share their expertise on related topics.

Awareness Session on Enhancing the Quality and Validation of Data Submitted to the Financial Intelligence Unit by Reporting Institutions - July 31, 2024

The Financial Intelligence Unit (FIU) of Sri Lanka, on July 31, 2024, conducted a hybrid session (in-person and online) focused on enhancing the validation of XML reports by Reporting Institutions (RIs), prior to their submission to the goAML system. With an impressive participation of around 300 participants in person and 200 participants online, the session attracted IT officers from all types of RIs, including Banks, Finance Companies, Insurance Companies, Stockbrokers, and MVTS Providers, along with audit staff and compliance officers.

Mr. Kosala Harshadewa, Senior Assistant Director/FIU led the session, by demonstrating a Python script developed to validate goAML XML files, to help RIs integrate the script into their respective systems to expand the scope of the validation process. In addition, Mr. Harshadewa introduced a Python-based tool developed to screen customers against applicable UN sanction lists. This tool was shared with the RIs.

Mr. Tharindu Wijethunga, Assistant Director/FIU conducted a refresher session to the participants on goAML reporting. This included a summary of both Web reporting and XML uploading to the goAML system, followed by questions and answer session on goAML related matters.

Awareness Programme on Managing Financial Crime Risks in the Financial Services Sector of Sri Lanka (Programme 12) - July 25, 2024

The twelfth awareness programme on “Managing Financial Crime Risks in the Financial Services Sector of Sri Lanka”, jointly organized by the Association of Compliance Officers of Banks (ACOB) and the Financial Intelligence Unit (FIU), was successfully conducted for the compliance officers and other related officers of financial institutions (FIs) at the Centre for Banking Studies (CBS) in Rajagiriya on July 25, 2024.

Representing Licensed Commercial Banks, Licensed Specialised Banks, Licensed Finance Companies and Money or Value Transfer Service Providers, 89 participants participated in the programme. As an extension of the eleventh awareness programme, global aspect of Customer Due Diligence and feedback on reporting Suspicious Transaction Reports (STRs) were discussed during the session.

Mr. Ivan N H Ng, Senior Compliance Advisory Manager, Commercial Banking and Global Banking of HSBC, Asia Pacific, Ms. Yashika Abeywickrema, Senior Financial Crime Compliance Manager, Commercial Banking & Global Banking of HSBC, Asia Pacific and Mr. A, W. U.C. N. Bandara, Senior Assistant Director of Financial intelligence Unit (FIU), addressed the sessions as resource persons.

Seminar on Anti-Money Laundering (AML) and Countering the Financing of Terrorism (CFT) Regulations for Lawyers - July 24, 2024

A seminar on Anti-Money Laundering (AML) and Couintering the Financing of Terrorism (CFT) Regulations for Lawyers, organised by the BASL Seminars COmmittee, is to be held on July 24, 2024 from 3.00 PM to 5.00 PM at the Bar Association Auditorium.

Justice Buwaneka Aluwihare, P.C., Former Judge of the Supreme Court and presently Chairman of the Cabinet appointed Task Force Monitoring the Compliance of AML/CFT Legal Regime, Dr. (Mrs.) Subhani Keerthiratne, AAL, Director of the Financial Intelligence Unit and Mr. Rajeev Amarasuriya, AAL, Governing Board Member of the Central Bank of Sri Lanka and Former Secretary of BASL are to be joining the seminar to share their expertise on related topics.

Awareness Programme on Managing Financial Crime Risks in the Financial Services Sector of Sri Lanka (Programme 11) - July 18, 2024

The eleventh awareness programme on “Managing Financial Crime Risks in the Financial Services Sector of Sri Lanka”, jointly organized by the Association of Compliance Officers of Banks (ACOB) and the Financial Intelligence Unit (FIU), was successfully conducted for the compliance officers and other related officers of Financial Institutions (FIs) at the Centre for Banking Studies (CBS), Rajagiriya on July 18, 2024.

Almost 107 participants representing Licensed Commercial Banks, Licensed Specialised Banks, Licensed Finance Companies and Money or Value Transfer Service Providers participated in the programme. Officers from Bank Supervision, Supervision of Non – Bank Financial Institutions, Foreign Exchange and Payments & Settlements departments of Central Bank of Sri Lanka joined for the programme.

The programme was inaugurated with the welcome remarks by Dr. Subhani Keerthirathne, Director of Financial Intelligence Unit (FIU). Mr. M. Rafiqul Islam, Head of Business Financial Crime, Wealth and Personal Banking of HSBC, Asia Pacific and Ms. Wangeesha Karunaratna, Deputy Director of Financial Intelligence Unit (FIU), addressed the sessions as resource persons.

Cryptocurrency Investigation Training for Law Enforcement Agencies by Binance in Collaboration with the Financial Intelligence Unit - July 11, 2024

Binance’s Financial Crime Compliance (FCC) team in collaboration with the Financial Intelligence Unit of Sri Lanka (FIU) conducted a cryptocurrency analysis and investigation training for the officers of the FIU, key stakeholders and law enforcement agencies. The session took place at the Centre for Banking Studies in Rajagiriya, on July 11, 2024.

The training session focused on practical techniques for cryptocurrency investigations and incorporating real-world case studies from Binance’s extensive experience in the field. Participants received an informative training that equipped them with the skills to understand the concepts of blockchain and cryptocurrency, Trace illicit transactions, Identify malicious actors, Navigate the complexities of the digital blockchain ecosystem and cooperation with Binance on cryptocurrency related investigations.

Mr. Jarek Jakubcek, Head of Law Enforcement Training at Binance and Mr. Ferdinando D. P., Investigation specialist at Binance shared their expertise and experience on cryptocurrency related analysis and investigations. The session provided valuable insights that would aid the efforts in combatting digital crimes.

Third Anti-Money Laundering and Countering the Financing of Terrorism (AML/CFT) Familiarization Programme for Restricted Dealers in Sri Lanka - July 09, 2024

The Third Anti-Money Laundering/Countering the Financing of Terrorism (AML/CFT) Familiarization Programme for Restricted Dealers in Sri Lanka was conducted successfully by the Financial Intelligence Unit (FIU) in collaboration with the sector regulator, Department of Foreign Exchange (DFE) at the Central Bank of Sri Lanka on July 9, 2024.

The primary objective of this programme was to raise awareness on “UNSCR sanction screening” and “onducting an institutional risk assessment” and “enhance the capacity on AML/CFT compliance matters”, of the Compliance Officer’s of Restricted Dealers (RDs). 48 participants representing 44 Restricted Dealer institutions participated in this programme and, it underscores the widespread interest and collective effort within the sector to address AML/CFT concerns and strengthen compliance measures.

The programme was inaugurated with the welcome remarks by Mrs. Theja Pathberiya, Deputy Director of FIU. The session was then addressed by Mrs. A P Liyanapatabendi, Director of DFE who emphasized the importance of complying as a responsible money changer.

Mr. Kosala Harshadewa Head of Financial Data Management Division of FIU and Mrs. A.D Premathilaka, Senior Assistant Director from the Supervision Division of FIU conducted the sessions as resource persons. Concluding remarks were delivered by, Dr. Ayesh Ariyasinghe, Additional Director of the FIU.

Awareness Programme on Managing Financial Crime Risks in the Financial Services Sector of Sri Lanka (Programme 10) - June 27, 2024

The tenth awareness programme on “Managing Financial Crime Risks in the Financial Services Sector of Sri Lanka”, was conducted successfully for Financial Institutions (FIs) jointly by the Association of Compliance Officers of Bank (ACOB) and the Financial Intelligence Unit (FIU) at the Centre for Banking Studies (CBS), Rajagiriya on June 27, 2024.

88 participants representing different divisions of Licensed Banks, Licensed Finance

Companies and Money or Value Transfer Service Providers participated in the

programme.

Mr. James Rothwell, Head of Financial Crime Investigations of HSBC Asia Pacific, Ms.

Rubie Tam, Head of External Investigative Reporting of HSBC Asia Pacific, Dr. Subhani

Keerthiratne, Director of FIU and Dr. Ayesh Ariyasinghe, Additional Director of FIU

addressed the session as resource persons.

Training Programme Conducted by The Wisconsin Project on ‘Risk Report’ Database and ‘Sanctions Impact’ Website - June 18-19, 2024

A training and briefing programme on the Wisconsin Project's ‘Risk Report’ database and ‘Sanctions Impact’ website was organized by the Embassy of the United States of America for domestic government authorities with participation from the Intelligence Agencies including Financial Intelligence Unit (FIU) among other relevant agencies. This initiative was undertaken by the Wisconsin Project, a private, non-profit, non-partisan organization based in Washington, D.C. USA, aimed at curtailing proliferation of mass destruction weapons at its source.

The two day training sessions featured subject experts Valerie Lincy, Executive Director of the Wisconsin Project, and John Caves, Senior Research Associate of the Wisconsin Project, who shared their expertise on UN and OFAC related sanctions evasion and methods for identifying sanctions evasion techniques and methods to identify risky parties, information about dual-use goods and applying advanced search techniques.

The programme was held at the Metropolitan Campus KDU, Colombo 01, with participants from government authorities such as Sri Lanka Customs, Department of Immigration and Emigration, Import and Export Control Department, etc. along with five participants representing the Financial Intelligence Unit. The training also included practical exercises designed to equip the participants with knowledge and strategies to combat proliferation of mass destruction weapons as well as terrorist financing.

Awareness session on “Anti-Money Laundering and Countering the Financing of Terrorism Obligations of Gem and Jewellery Dealers” - May 28,2024

An awareness program on “Anti-Money Laundering and Countering the Financing of Terrorism (AML/CFT)” was conducted for Gem and Jewellery Dealers of the Southern Province on May 28, 2024, in collaboration with the National Gem and Jewellery Authority (NGJA).

Approximately 25 participants attended this awareness program. Ms. Janani Dayaratne, Assistant Director (Legal) at the NGJA, explained the purpose of the awareness session. Furthermore, a presentation on the online export process was conducted by the officials of the NGJA. Ms. Hashini Rangika, Senior Assistant Director, and Ms. Malsha Rathnayake, Senior Assistant Director of the Financial Intelligence Unit (FIU), delivered two presentations on the Role of the FIU and AML/CFT Compliance Obligations.

Awareness Session on “Anti-Money Laundering and Countering the Financing of Terrorism Compliance Obligations for Accounting Professional” - May 20,2024

An awareness session on AML/CFT Compliance Obligations for Accountants was conducted on May 20, 2024, in collaboration with the Institute of Chartered Accountants in Sri Lanka (ICASL). The session was held as a hybrid event at ICASL and was also virtually streamed via the Zoom platform.

The welcome address was delivered by Mr. Saman Sri Lal, Chairman of the Committee on Professional Accounts in Practice. The keynote address was given by Dr. Subhani Keerthiratne, Director of the Financial Intelligence Unit (FIU). Dr. Gordon Hook, International AML/CFT Consultant, Dr. Ayesh Ariyasinghe, Additional Director of FIU, and Ms. Wangeesha Karunaratna, Deputy Director of FIU, participated as resource persons for the session. Around 80 ICASL members attended the session.

The session included a panel discussion moderated by Mr. Laknath Jayawickrama, Council Member of ICASL. The panelists were Dr. Subhani Keerthiratne, Director of FIU; Mr. Tishan Subasinghe, Vice President of ICASL; Mr. Neomal Goonewardena, Founding Partner of Nithya Partners; and Mr. Manil Jayesinghe, the President and Immediate Past President of ICASL.

Awareness Session on Anti-Money Laundering and Countering the Financing of Terrorism for the Lawyers in Employment Sector (Session 1) - May 15,2024